Optim Debt

Optimizing investment and debt management for public and local authorities.

Optim Debt is a comprehensive debt management solution, enabling public and local authorities to optimize the financing of their investments.

Local authorities, public healthcare establishments, social housing Associations, or institutional bodies: for over 20 years, stakeholders in the local public sector have trusted us and used Optim Debt to manage their debt portfolios.

From seeking new loans to renegotiation, including monitoring, valuation, or reporting, Optim Debt is a comprehensive and intuitive service that supports you at every stage, both strategically and operationally, in order to make the right decisions.

2,500+

Public sector clients

96%

Client loyalty

6

Offices in Europe

90

Experts of our public sector team

Key features

A simple and reliable debt management solution

Approach your borrowing projects under the best conditions

Monitoring for new borrowings, debt restructuring projects, or bank negotiations: Finance Active's Offers Journal proves to be a valuable source of information for visualizing the historical rates and average margins offered, comparing oneself to other entities in the same category, and identifying the best offers available in the market.

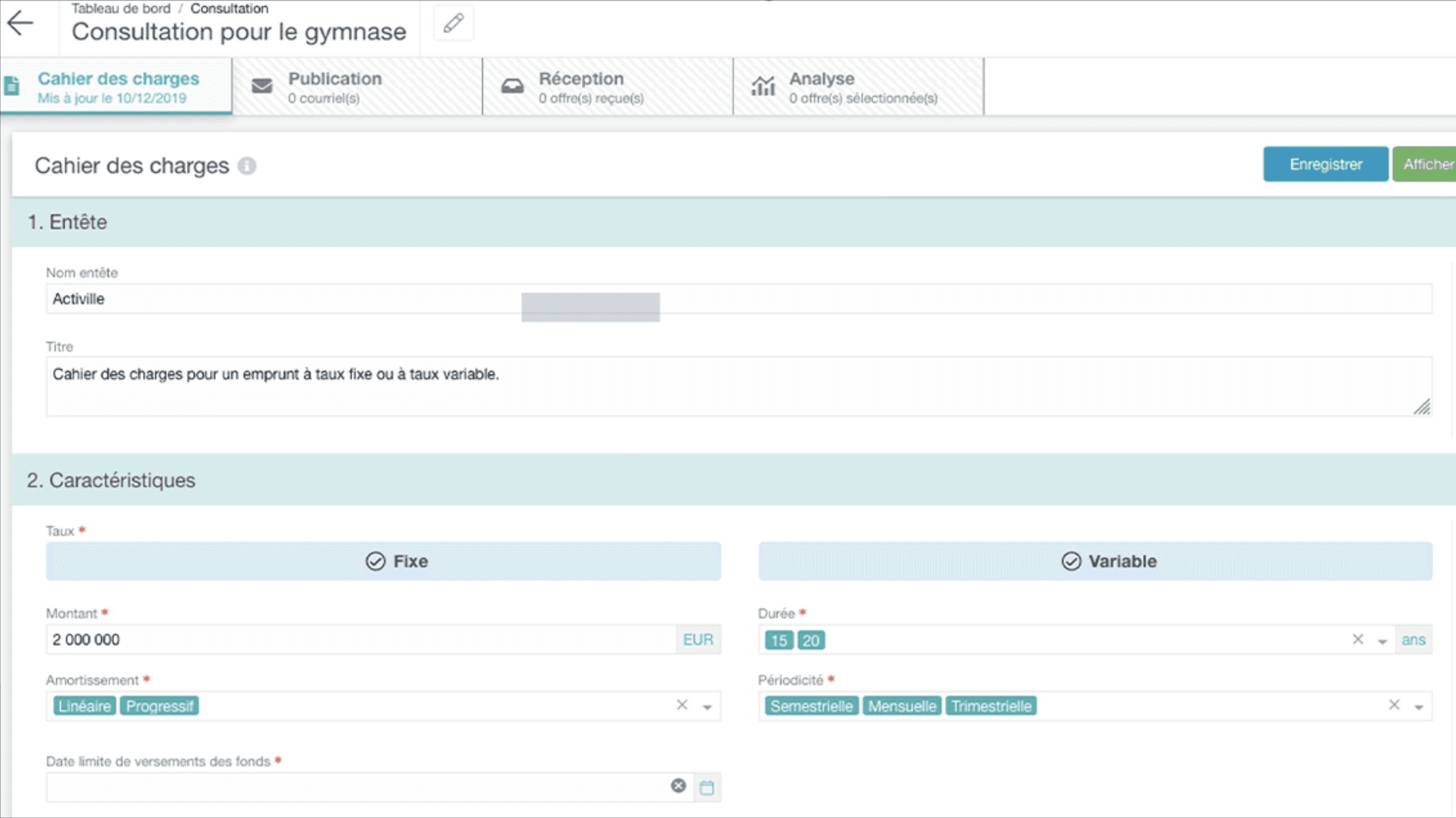

Thanks to its Call for Tenders Module, Optim Debt also accompanies you at every stage of your bank consultations. It becomes the preferred contact interface with various lenders and assists you in selecting the most relevant offers, serving your financing strategy.

Simplified debt monitoring

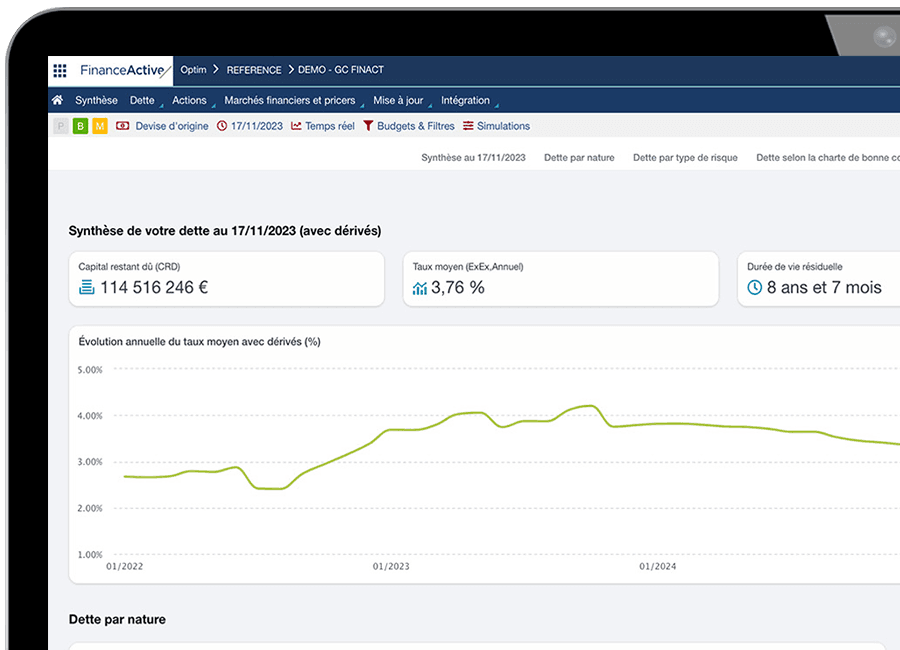

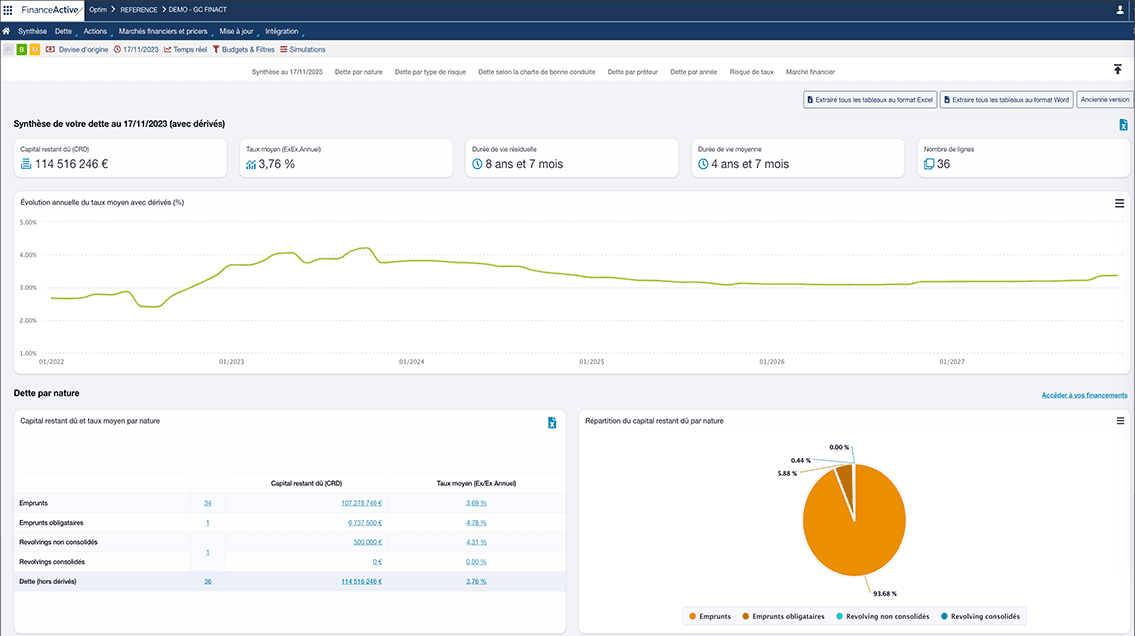

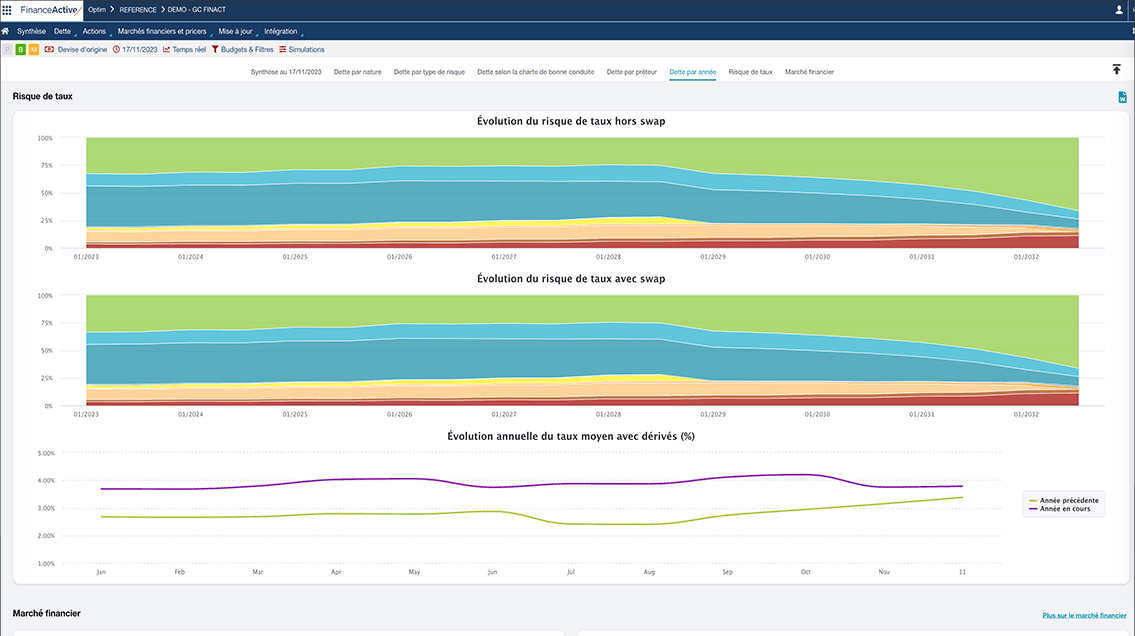

Optim Debt simplifies debt monitoring by providing comprehensive insights and tools with just a few clicks.

Easily access all of your loans and coverage details, including summary sheets and digitized contracts, average financing rates, and repayment profiles, and analyze risks accurately.

You benefit from an intuitive interface to manage financial expenses, interest calculations, liquid assets, bank counterparts, and contractual notice periods, with payment schedules automatically updated.

Enhance your operations in real time

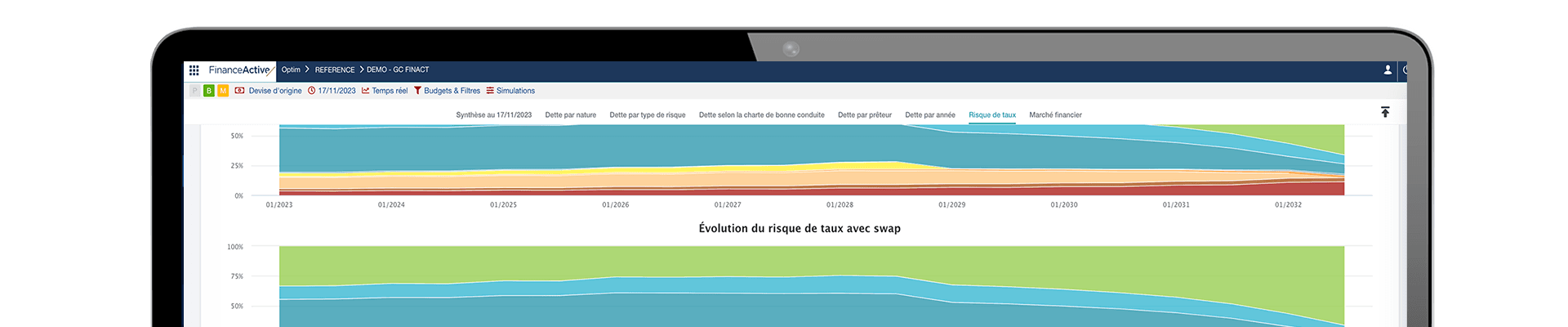

Optim Debt provides continuous access to real-time market data, including rate curves, swap curves, variable indexes, exchange rates, historical rates, forward rates, and market expectations, along with real-time mark-to-market valuations.

Through Optim Debt, users can evaluate and simulate various strategies concerning loans or hedging, assess margins and hidden costs in bank proposals, determine probabilities of threshold crossing, and conduct debt restructuring and stress tests.

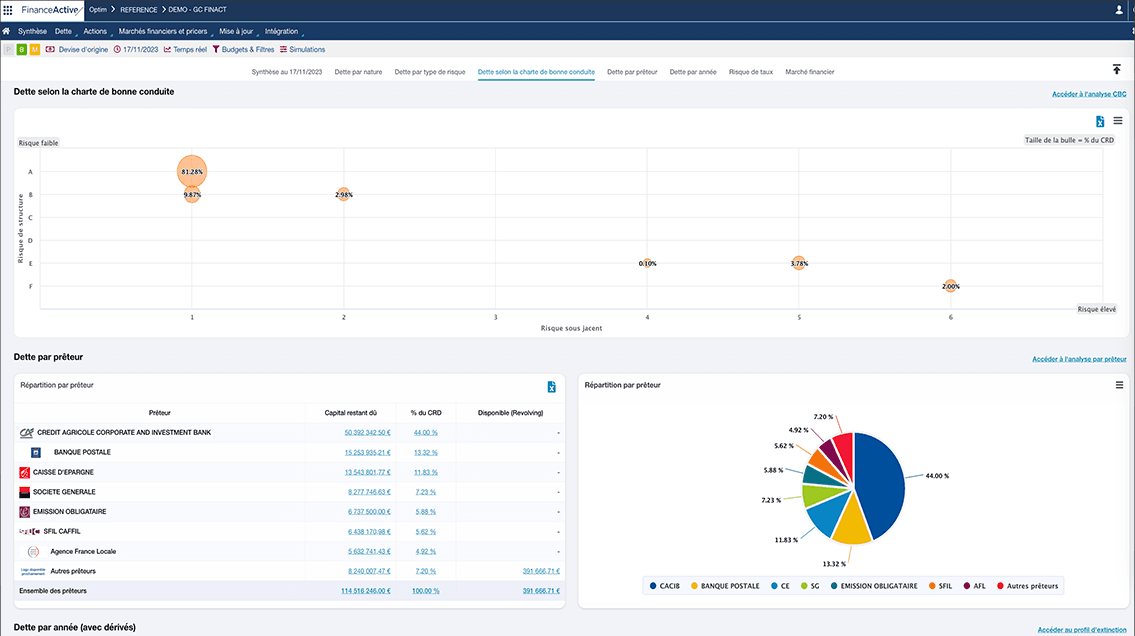

Simplified report generation

Optim Debt simplifies report generation with intuitive dashboards, providing users with easy access to strategic insights and key performance indicators.

Our offering includes a wide range of strategic, financial, and regulatory reports using consolidated data, ensuring a comprehensive analysis that closely meets our clients' needs.

Seamless integration and ongoing support

During deployment, new users benefit from the intervention of our back-office to ensure optimal integration of their data and solution configuration.

Annual debt audit, regular follow-up meetings, assistance in setting up new financing or hedging instruments, analysis of banking proposals received in the context of restructuring operations, regulatory assistance, and best practices for using the SaaS solution: these are some of the areas where our clients then benefit from the support of a dedicated consultant to ensure the best choices in their financial management.

Community

Expand your network and skills through the Finance Active Club

Users gain access to a multimedia space 100% dedicated to the public sector for simple information analysis, a comprehensive program of events and conferences to stay informed and engage with peers, and a continuous training program to improve their skills over time.

As a true benchmark study of the local public sector for comparing key figures with entities of the same strata and size, our clients benefit each year from access to the Finance Active Observatory of debt through an interactive tool and dedicated analysis formats.

Why Finance Active

Over 20 years pioneering debt management and financial risk forecasting solutions

Optim Debt sets itself apart with its intuitive user interface, extensive operational support, and expert guidance, guaranteeing transparent tracking and optimized performance for your organization.

By merging our technology and expertise, we deliver a centralized solution to local public sector entities for monitoring their debt portfolios, controlling expenses, mitigating risks, capitalizing on opportunities, and enhancing debt conditions.

Greater transparency

Receive deeper insights and intelligence into your investment portfolio, empowering you to make informed financial decisions and optimize performance.

Compliance & security

Easily adhere to regulatory requirements with our continuously updated tools, and enjoy a secure environment safeguarding your data.

Proactive risk mitigation

Model market scenarios to effectively measure exposure, identify hidden risk factors, and proactively optimize financial strategies.

Optimal cost control

We offer efficient cost control through transparent pricing models, allowing you to manage expenses effectively and maximize returns on investments.

SaaS model

Our solutions are specially designed for the web, continuously connected to financial markets, and easily integrated with your information system.

Expert support

Access dedicated support from our team of experts, ensuring smooth deployment, ongoing assistance, and strategic guidance tailored to your organization's needs.